RevaNail is a 100% natural formula that supports healthy nail health while promoting daily energy and overall wellness. Made with herbal extracts and plant-based nutrients, it’s designed to help maintain strong, vibrant nails and total body balance. Click here to learn more 👉https://revanail.co.uk/

Discover posts

Enjoy a New Year’s Eve dinner cruise on a beautiful traditional dhow boat in Dubai. The package includes a buffet dinner, drinks and live entertainment while you cruise and watch the fireworks display across the water.

To know more details visit us: https://newyeardubaipackage.co....m/new-year-dhow-crui

LipoVive is a 100% natural formula that supports healthy weight management while boosting daily energy and overall wellness. Made with herbal extracts and plant-based nutrients, it’s designed to promote total body balance, vitality, and a healthier lifestyle. Click here to learn more 👉https://lipovivi.com/

DigestiStart is a 100% natural formula that supports healthy gut health while promoting daily energy and overall wellness. Made with herbal extracts and plant-based nutrients, it’s designed to help maintain digestive balance, vitality, and total body wellness. Click here to learn more 👉https://digestistart-usa.us/

DigestiStart is a 100% natural formula that supports healthy gut health while promoting daily energy and overall wellness. Made with herbal extracts and plant-based nutrients, it’s designed to help maintain digestive balance, vitality, and total body wellness. Click here to learn more 👉https://digestistart-canada.ca/

LeanBiome is a 100% natural formula that supports healthy gut health while promoting daily energy and overall wellness. Made with herbal extracts and plant-based nutrients, it’s designed to help maintain digestive balance, vitality, and total body wellness. Click here to learn more 👉https://leanbiome.au/

Registered Cleaning Services

If you are searching for professional cleaners service Melbourne & Dandenong in Australia and Brighton, then visit us or call us now to avail the services.

https://cheap247cleaningservices.com.au/

Trusted Fish Store in Austin for Healthy Fish and Expert Care

Finding a reliable Fish Store in Austin is essential for anyone who values healthy fish, expert guidance, and dependable service. At ChuChuGoldfish, we are proud to be a trusted destination for hobbyists and beginners seeking quality aquatic life backed by professional care and support. For more information: https://sites.google.com/view/fish-store-in-austin

NeuroXen is a 100% natural formula that supports healthy brain health while promoting daily energy and overall wellness. Made with herbal extracts and plant-based nutrients, it’s designed to help maintain mental clarity, focus, and total body balance. Click here to learn more 👉https://neuroxen.uk/

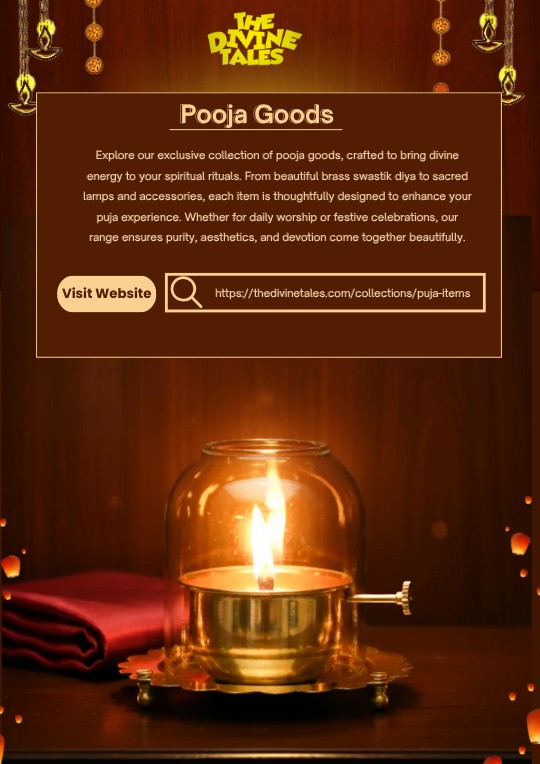

Enhance your spiritual practices with premium pooja goods that reflect purity and tradition. Designed for comfort and authenticity, these items help you stay focused and connected during rituals. Whether for personal worship or religious ceremonies, our pooja goods create a peaceful environment filled with divine grace. Visit shop ---->>> https://shorturl.at/Csr89