Discover posts

https://backlinksseo.in/the-st....rategic-importance-o

The AI‑Powered KDP Cash Engine Nobody Talks About (But Everyone Needs)

https://medium.com/@najet.hamd....i08/the-ai-powered-k

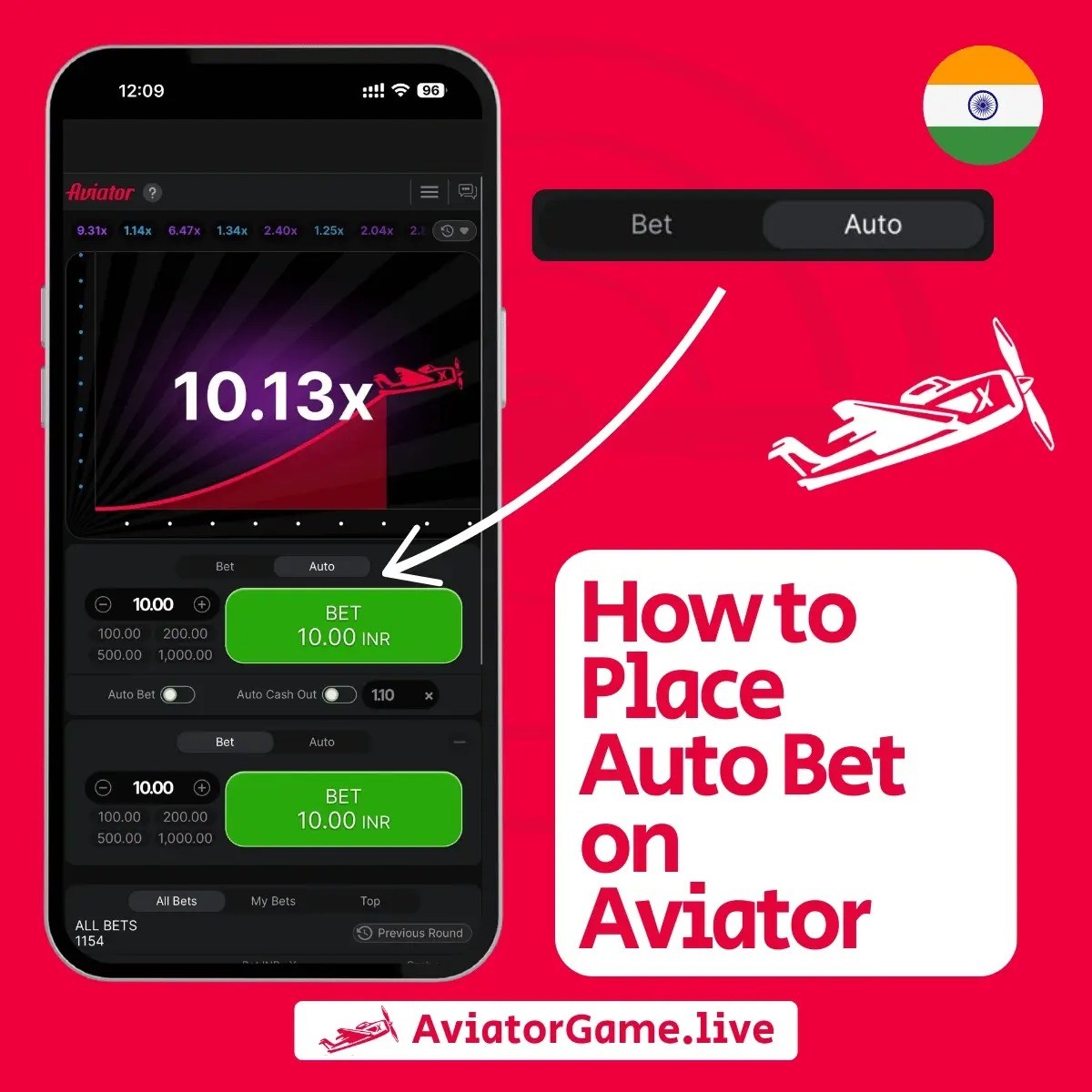

Spribe Aviator | Aviator Game

Try spribe aviator for an unforgettable gaming experience, full of thrilling moments and big wins. Visit Aviator Game to enjoy smooth gameplay, interactive features, and challenges designed for all players. Elevate your online gaming sessions with this unique, fast-paced aviation game experience.

https://aviatorgame.live/

How Rising Cancer Rates Are Driving Demand in the Biopsy Devices Market

How Rising Cancer Rates Are Driving Demand in the Biopsy Devices Market

The global biopsy devices market is experiencing strong, sustained growth as cancer incidence rises worldwide, medical screening programs expand, and healthcare systems shift toward early and accurate disease diagnosis. According to the latest Stellar Market Research forecast, the biopsy devices market was valued at approximately USD 3.94 billion in 2024 and is expected to grow to about USD 7.11 billion by 2032 at a compound annual growth rate (CAGR) of around 7.67%.

Understanding how increasing cancer rates are fueling this demand requires appreciating the pivotal role biopsy procedures play in cancer diagnosis, staging, and treatment planning.

Request Free Sample Report : https://www.stellarmr.com/repo....rt/req_sample/biopsy

The Rising Global Cancer Burden

Cancer remains one of the world’s most significant public health challenges. According to international health data, nearly 20 million new cancer cases and almost 9.7 million cancer‑related deaths were reported globally in 2022, with projections estimating that the number of new cases could increase to more than 35 million by 2050 — a near 80% rise from 2022 levels.

This upward trajectory reflects aging populations, lifestyle changes, environmental risk factors, and shifts in global disease patterns. As cancer prevalence increases, so does the need for precise and timely diagnosis — and at the center of that diagnostic pathway are biopsy procedures.

Biopsy: The Gold Standard in Cancer Diagnosis

A biopsy is the clinical process of removing a small piece of tissue from the body so it can be tested in a laboratory to determine if disease, such as cancer, is present. It is often the definitive method to confirm cancer, establish subtype and grade, and guide therapeutic decisions.

While imaging modalities like MRI, CT scans, and ultrasounds can suggest abnormalities, only a biopsy can confirm malignancy and determine the tumor’s biological characteristics. This makes biopsy devices indispensable — especially in the face of rising cancer incidence.

Increasing Screening and Early Detection Programs

Government initiatives and public health campaigns aimed at early cancer detection are also amplifying demand for biopsy devices. Screening programs — such as mammography for breast cancer, colonoscopy for colorectal cancer, and prostate screening protocols — often lead to follow‑up biopsies when suspicious lesions are detected.

Earlier detection leads to greater survival odds and improved treatment outcomes. But it also means more tissue samples must be collected and examined, directly boosting the usage of biopsy instruments.

Request Free Sample Report : https://www.stellarmr.com/repo....rt/req_sample/biopsy

Shift to Minimally Invasive and Image‑Guided Techniques

Cancer biopsy procedures have shifted dramatically from traditional open surgical techniques toward minimally invasive, image‑guided methods. Innovations such as ultrasound‑guided biopsies, vacuum‑assisted biopsy systems, and stereotactic imaging have improved diagnostic precision while reducing patient discomfort, recovery time, and procedural risk.

Minimally invasive approaches are now the mainstream in breast, prostate, liver, and lung biopsies — which are among the most common cancers globally. These technological advances encourage wider adoption of biopsy devices, enhancing accuracy and workflow efficiency in clinical settings.

Demand Driven by Specific Cancer Types

Certain cancers contribute disproportionately to biopsy demand due to their incidence rates and diagnostic requirements:

Breast Cancer: Widely recognized as one of the most common cancers, breast cancer alone accounts for millions of biopsy procedures annually. Clinicians rely on biopsy sampling to confirm suspicious findings from mammography or MRI scans, determine malignancy, and tailor treatment.

Prostate Cancer: Prostate biopsies remain critical in diagnosing and staging prostate tumors — a leading male cancer worldwide. The rise in prostate cancer incidence, particularly in aging populations, continues to expand biopsy device utilization.

Other Cancers: Lung, colorectal, and gastrointestinal cancers similarly require biopsy confirmation for diagnosis and personalized treatment planning, further broadening the need for diverse biopsy solutions.

Broader Market and Healthcare Trends

Beyond cancer detection, other factors enhance biopsy device demand:

Aging Population: Cancer risk increases with age, and the global demographic shift toward older populations contributes to higher biopsy requirements as a natural consequence of rising disease prevalence.

Technological Evolution: Continued enhancements in robotic assistance, real‑time imaging integration, and disposable single‑use systems are making biopsy procedures safer and more efficient, encouraging widespread clinical adoption.

Healthcare Infrastructure Expansion: Especially in emerging economies, investments in medical infrastructure and diagnostic services improve access to biopsy procedures, helping to bridge gaps in cancer care delivery worldwide.

Conclusion: Rising Cancer Rates Fuel Biopsy Device Demand

The increasing global burden of cancer is a central driver of demand in the biopsy devices market. As cancer incidence rises — alongside early detection initiatives and preference for minimally invasive methods — the need for effective, precise biopsy solutions is intensifying.

Biopsy procedures remain the gold standard for cancer diagnosis, and rising case numbers, improved screening adoption, and advanced biopsy technologies are expanding market potential. The biopsy devices market’s projected growth to more than USD 7 billion by 2032 demonstrates how disease trends are deeply intertwined with medical innovation and healthcare system priorities.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com

Elegant and Secure Modern Entry Doors for Every Home

We believe that the right entrance sets the tone for your entire home. At TWD Supplies, our modern entry doors are designed to combine contemporary aesthetics with superior strength and energy efficiency. We help clients choose from a variety of finishes, materials, and hardware options to match their unique style. Each door is crafted for durability, long-lasting performance, and visual appeal. By partnering with us, you benefit from our experience, attention to detail, and commitment to quality. Elevate your home’s first impression with doors that are both stylish and functional. https://twdsupplies.com/entry-door-supplier/

ORDER NOW : https://healthyifyshop.com/OrderHumeHealthBodyPod

Hume Health Body Pod is more than just a wearable, it’s a complete metabolic intelligence system.

FOR MORE INFORMATION :

https://www.facebook.com/HumeH....ealthBodyPodOfficial

https://www.facebook.com/HumeHealthBodyPodBuy/

https://www.facebook.com/group....s/hume.health.body.p

https://www.facebook.com/event....s/1281923550359569/1

https://sites.google.com/view/....hume-health-body-pod

https://sites.google.com/view/....bodypodby-hume-healt

https://sites.google.com/view/....hume-health-bodypod-

https://sites.google.com/view/....hume-health-body-pod

https://groups.google.com/g/hu....me-health-body-pod-c

https://groups.google.com/g/hu....me-health-body-pod-c/c/r6ChWNm3iOQ

https://groups.google.com/g/hu....me-health-body-pod-c/c/FVFMojWqRk4

https://groups.google.com/g/hu....me-health-body-pod--

https://groups.google.com/g/hu....me-health-body-pod--/c/JFrM8V_64G0

https://groups.google.com/g/hu....me-health-body-pod--/c/AoU8wQOYu60

https://site-qw62rxpcd.godaddysites.com/

https://in.pinterest.com/sagar....kumari95950/hume-hea

https://in.pinterest.com/pin/1138214505845234545/

https://in.pinterest.com/sagar....dev7102003/hume-heal

https://in.pinterest.com/pin/1091700765943530117/

https://teeshopper.in/store/Hu....me-Health-Body-Pod-S

https://teeshopper.in/store/Hu....me-Health-Body-Pod-S

https://teeshopper.in/store/Hu....me-Health-Body-Pod-S

https://teeshopper.in/store/Hume-Health-Body-Pod

https://hume-health-body-pod-w....almart.jimdosite.com

https://hume-health-body-pod-amazon.jimdosite.com/

https://hume-health-body-pod-store.jimdosite.com/

https://hume-health-body-pod-site.jimdosite.com/

https://humehealthbodypodofficial.quora.com/

https://x.com/XmanSagar6812/st....atus/199175595022787

https://medium.com/@sugarmute4....7/hume-health-body-p

https://www.linkedin.com/feed/....update/urn:li:activi

https://www.reddit.com/r/heat/....comments/1pzdqdn/hum

https://humehealthbodypodpage.quora.com/

https://www.commudle.com/users/HumeHealthBodyPod

https://www.pinterest.com/zana....rime/hume-health-bod

https://www.pinterest.com/pin/894175701036360315/

https://www.pinterest.com/vita....lwristball/hume-heal

https://www.pinterest.com/pin/1012535928744676549/

https://www.pinterest.com/vira....jsharma7102003/hume-

https://www.pinterest.com/pin/1082341722962065115/

https://www.pinterest.com/shiv....amkumar7102003/hume-

https://www.pinterest.com/pin/882846333215865164/

https://www.pinterest.com/sema....glutide521/hume-heal

https://www.pinterest.com/pin/1005780529293448135/

https://x.com/Sagar7217872752/....status/2000853376981

https://x.com/BallVital3772/st....atus/200085393787711

https://x.com/VirajSharm67526/....status/2000854390190

https://x.com/shivamkuma50849/....status/2000854967410

https://x.com/sagarxte/status/2000855756418244652

https://www.pinterest.com/dev1....faces/hume-health-bo

https://www.pinterest.com/dev1....faces/hume-health-bo

https://in.pinterest.com/healt....hify656/hume-health-

https://in.pinterest.com/pin/1069745717766080737/

https://in.pinterest.com/healt....hji65/hume-health-bo

https://in.pinterest.com/pin/930485973036211011/

https://www.pinterest.com/lept....icell84/hume-health-

https://www.pinterest.com/pin/927319379542379362/

https://www.pinterest.com/mart....hastewartcbd01/hume-

https://www.pinterest.com/pin/1107955945848192979/

https://x.com/DevFace187789/st....atus/200125998632500

https://x.com/Healthify857665/....status/2001260394258

https://x.com/Healthji177588/s....tatus/20012606129665

https://x.com/lepticell158661/....status/2001260985869

https://x.com/MarthaC77400/sta....tus/2001261574712078

https://medium.com/@dev1faces/....hume-health-body-pod

https://medium.com/@healthify6....56/hume-health-body-

https://www.pinterest.com/anti....snoringsolution/hume

https://www.pinterest.com/pin/1082904672920276247/

https://www.pinterest.com/natu....resreserve08/hume-he

https://www.pinterest.com/pin/1127096244285702543/

https://www.pinterest.com/peop....lesketogummies100/hu

https://www.pinterest.com/pin/1004021310689981622/

https://www.pinterest.com/pure....kanacbdgummies00312/

https://www.pinterest.com/pin/1010565603897053958/

https://www.pinterest.com/radi....antcbdgummies0039/hu

https://www.pinterest.com/pin/950329958885910277/

https://x.com/Antisnorin32099/....status/2001571973739

https://x.com/NatureS54767/sta....tus/2001572408055189

https://x.com/Peoplesket48099/....status/2001572787799

https://x.com/Purekanacb/statu....s/200157317469847152

https://x.com/RGummies97762/st....atus/200157365630532

https://www.pinterest.com/sago....rbadmosh/hume-health

https://www.pinterest.com/pin/973973856936466884/

https://www.pinterest.com/saga....rdevx/hume-health-bo

https://www.pinterest.com/pin/865254147170735006/

https://www.pinterest.com/sgr2....00321/hume-health-bo

https://www.pinterest.com/pin/981925525018447419/

https://www.pinterest.com/sgrh....lth/hume-health-body

https://www.pinterest.com/pin/1041246376361431340/

https://www.pinterest.com/pure....cbdgummies1/hume-hea

https://www.pinterest.com/pin/1056868237570728211/

https://x.com/SagorB17983/stat....us/20022422144880724

https://x.com/sagar1270048/sta....tus/2002242903201210

https://x.com/health_sag47891/....status/2002243361999

https://x.com/XmanSagar6812/st....atus/200224367818278

https://x.com/Purecbdgum84893/....status/2002243949990

https://medium.com/@sagorbadmo....sh/hume-health-body-

https://medium.com/@tarunbhai6....59/in-a-world-where-

https://www.pinterest.com/proh....ealthketoacvgummies0

https://www.pinterest.com/pin/1017813584547372510/

https://in.pinterest.com/mithl....eshdevi1111/hume-hea

https://in.pinterest.com/pin/1123577807049878509/

https://www.pinterest.com/bolt....zretrodevice0033/hum

https://www.pinterest.com/pin/1014365516191465785/

https://x.com/sgr12121232131/s....tatus/20026221311176

https://x.com/Boltzretro25543/....status/2002623024764

https://medium.com/@prohealthk....etoacvgummies_18801/

https://medium.com/@boltzretro....device_52868/hume-he

https://pin.it/1ZGndAW0e

https://x.com/DeepakPara31019/....status/2012786455538

https://x.com/MariaWilso59867/....status/2012787942729

https://in.pinterest.com/deepa....kparab9494/hume-heal

https://in.pinterest.com/pin/1084523154030973512/

https://groups.google.com/g/hu....me-health-body-pod-f

https://groups.google.com/g/hu....me-health-body-pod-f/c/JOjRFLznlGA

https://groups.google.com/g/hu....me-health-body-pod-f/c/yHtSNZfyX78

https://medium.com/@deepakpara....b9494/order-now-hume

https://medium.com/@maria.wils....on8787/order-now-hum