Expert MVP Development Company for Startup Success Growth

Our MVP development company builds scalable products fast, helping startups validate ideas, reduce costs, and launch successfully in competitive markets.

visit now: https://www.iotric.com/mvp-development-company/

Discover posts

Reliable and Professional Delivery Service Cobb County GA for Business Efficiency

A trusted delivery service Cobb County GA plays an essential role in supporting business operations, customer relations, and day-to-day logistics. Companies across the region rely on dependable transportation partners to move goods safely, promptly, and professionally. For more information please visit : https://medium.com/@deliveryse....rvicedavis_53444/rel

Restore Strength and Clarity: Why Window Chip Repair Edmonton Matters More Than You Think

Expert technicians use industry-grade tools and advanced resin injection methods to restore the chip, reinforcing the structural strength of the glass. A proper repair prevents further spreading, maintains visibility, and safeguards the factory seal that contributes to your vehicle’s overall stability.

For More Information: https://window-chip-repair-edm....on-j0pt9ns.gamma.sit

Wedding Gift – Elegant and Memorable Presents

Choose a special wedding gift from Deodap, offering stylish and practical options for newlyweds and celebrations.

https://deodap.in/collections/wedding-gifts

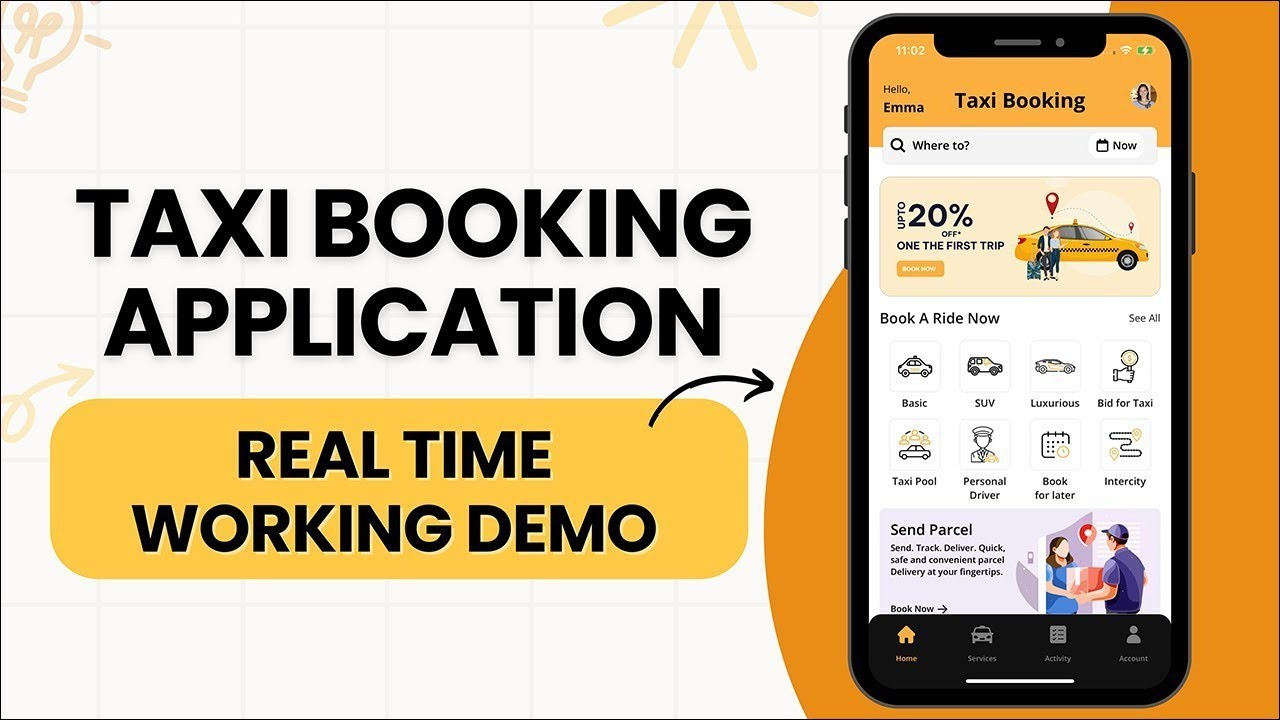

Taxi Clone App Development: Build an Uber-Like Ride-Hailing Platform

https://github.com/v3cubetechnolabs/taxi-clone

Build a powerful taxi clone app like Uber with advanced features, real-time tracking, secure payments, and scalable ride-hailing solutions.

#taxicloneapp #ridehailing #uberlikeapp #taxiapp #appdevelopment

Virtual Power Plants in the NT: How Your Battery Can Earn You Money

Your home battery storage system can do more than just store solar energy and provide backup power. Through Virtual Power Plant (VPP) programs, Darwin homeowners can earn money by allowing their batteries to support the NT grid during peak demand periods.

This guide explains how VPP Darwin programs work, what you can expect to earn, and why VPP-capable batteries are now required for the NT Battery Grant Scheme. Whether you live in Darwin, Palmerston, Alice Springs, Katherine, or Tennant Creek, understanding VPPs helps you maximise your battery investment.

Know More: https://www.podbean.com/eas/pb-if23q-1a503f7

Benefits of RO Water? Advantages of Commercial RO Plant Water | Netsol Water

Netsol Water is a water and wastewater treatment company in Noida, Delhi NCR, India that designs, and manufactures ace machines to save the earth and its resources, especially water.

Visit the link of video for more information:

Home Cinema Installation Provider in Dubai: Complete Service Guide

Transforming a room in your villa into a fully functional private cinema requires more than purchasing equipment online and following instruction manuals. Professional home cinema installation provider in Dubai services ensure every component works together seamlessly, performs optimally in your specific space, and delivers the immersive entertainment experience that justifies your investment. For villa owners across Dubai's premium communities, choosing the right installation partner determines whether your cinema room exceeds expectations or falls short of its potential.

Read More: https://www.podbean.com/eas/pb-wsms5-1a4f93b